National Cancer Centre Singapore will NEVER ask you to transfer money over a call. If in doubt, call the 24/7 ScamShield helpline at 1799, or visit the ScamShield website at www.scamshield.gov.sg.

MediSave, MediFund & MediShield Life

In NCCS, you may use MediSave to pay for certain outpatient expenses incurred by you or your immediate family members (spouse, children, parents and grandparents). Grandparents must be Singapore citizens or permanent residents.

MediSave covers:

- Medicines

- Investigations

- Surgical operation fee

For more information on the MediSave scheme, you can refer to the MediSave information on MOH’s website. You can also contact the CPF Board at Tel : 1800-227 1188 or visit their website. Ministry of Health at Tel : 1800-225 4122

MediSave covers up to

- Medical/surgical inpatient cases

Up to S$450 per day for daily hospital charges (patient must stay in hospital at least 8 hours unless he/she is admitted for a day surgery). This includes a maximum of S$50 for doctor's daily attendance fees. - Approved day surgeries

Up to S$300 per day for daily hospital charges. - Surgical operations (inpatient and day surgery)

Depending on the complexity of the operation, the limit fixed according to the following table of surgical operation:

| Table of Operations | MediSave Withdrawal Limits |

| 1A - 1C | S$250 - S$450 |

| 2A - 2C | S$600 - S$950 |

| 3A - 3C | S$1250 - S$1850 |

| 4A - 4C | S$2150 - S$2850 |

| 5A - 5C | S$3150 - S$3950 |

| 6A - 6C | S$4650 - S$5650 |

| 7A - 7C | S$6200 - S$7550 |

- MediSave can be used for the following outpatient treatment:

| Type of treatment | MediSave Withdrawal Limits |

| Outpatient MRI scans, CT scans and other diagnostics for cancer patients | Up to $600 per year per patient |

| Radiotherapy for cancer patients | |

|

$80 per treatment |

|

$300 per treatment |

|

$360 per treatment |

|

$30 per treatment |

|

$2,800 per treatment |

Activation of MediSave

- MCAF-S (Single)

MCAF-S allows you to decide and provide limited consent on the utilization of your MediSave.

You can choose to limit the type of schemes and/or the period which you would like to authorize for the MediSave to be used.

- Download the PDF form into your phone/computer

- Mail the completed form to

National Cancer Centre Singapore

Business Office

30 Hospital Boulevard,

Singapore 168583

- MCAF-M (Multiple)

MCAF-M allows you to grant full consent to use your MediSave at all MediSave accredited healthcare institutions.

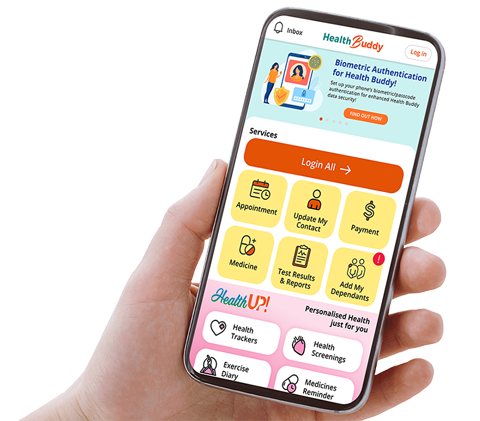

MCAF-M provides ease as you simply need to sign once, for life, unless revoked.- Submit your MCAF(M) authorization electronically via HealthHub

- Login with your SingPass

- Follow the steps below

MediFund is an endowment fund set up by the Government to help needy Singapore citizens who have difficulty in paying for their heavily subsidised medical care at restructured hospitals. It is a safety net for patients who face financial difficulties with their remaining bills after receiving Government subsidies and drawing on other means of payments including MediShield Life/Integrated Plans, MediSave and cash.

Eligibility for MediFund Assistance:

- Singapore citizen (does not apply to Permanent residents)

- Subsidised patient

- Received treatment from a MedFund approved institution

- Patient and family have difficulties affording the medical bill despite heavy government subsidies

Application for MediFund:

- Fix an appointment to see a Medical Social Worker (MSW) via a doctor’s referral

- Approach Department of Psychosocial Oncology to obtain a list of documents required for assessment after referral is made

- Documents are compulsory. Please bring the completed set of documents to the appointment with MSW in order for the application to be timely

Note: The amount of help from Medifund depends on your financial circumstances and the charges incurred.

MediShield Life (Basic) is a low-cost catastrophic medical insurance scheme which helps MediSave account holders and their dependants meet the cost of treatment for serious and prolonged illnesses.

If you are covered under MediShield Life at the time of your hospitalisation/treatment, you may claim part of your hospital bill from MediShield Life, by simply informing the staff handling your admission that you wish to make a MediShield claim. Non-Singaporeans who are covered by MediShield Life should inform the admission staff of their CPF account number.

The hospital will submit the MediShield Life claim on your behalf to the CPF Board. After processing, the Board will pay directly to the hospital. The remaining amount not covered by MediShield Life may then be settled by patients either with MediSave or cash or both.

The benefits of MediShield Life for outpatient cancer treatment:

| Treatment Type | Payout |

Radiotherapy - External or superficial - Brachytherapy |

$140 per session $500 per session |

| Maximum Claim Limits | |

| Per policy year | $100,000 |

| Lifetime | No limit |

| Maximum Cover Age | No maximum age |

| Co-insurance Payable by insured | |

| Outpatient | 10% |

For more information on MediShield Life scheme, you can refer to the MediShield Life information on MOH's website. You can also contact the CPF Board at 1800- 6227 1188 (toll-free) or visit their website. Ministry of Health at Tel : 1800-225 4122.

Keep Healthy With

© 2025 SingHealth Group. All Rights Reserved.